JANUARY2007

The FINANCIAL TIMES CHOICE - PERSON OF THE YEAR

Man of steel with a showman’s flair

By Peter Marsh

Published: December 22 2006 18:23 | Last updated: December 22 2006 18:23

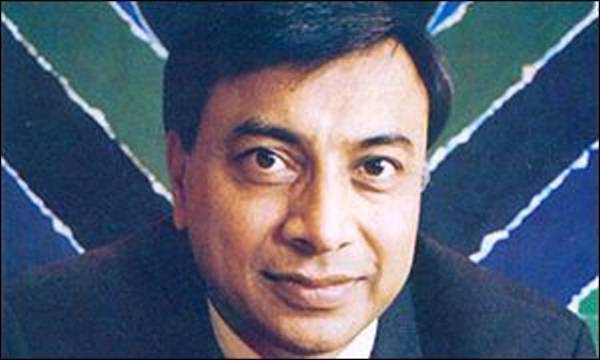

Lakshmi Mittal is spending Christmas at his Alpine holiday home in St Moritz to indulge his latest pastime: cross-country skiing. The 56-year-old businessman believes the downhill version of the sport is for “lazy people” and prefers to push himself up hills instead.

Those who know the Indian steel entrepreneur would expect nothing less. Over the past three decades he has assembled, from the ground up, by far the world’s biggest steel business with three times the output of its closest rival. He has become the world’s fifth richest person, with a fortune estimated at $23.5bn by Forbes magazine.

But his achievement is more than amassing wealth or reviving an industry that was thought to be in its twilight years. Through a series of audacious and contrarian deals he has taken on “old world” economic interests with the pluck and spirit of the rising “new world”, acting as a standard bearer for wider shifts wherein the power and money lies.

The high spot was Mittal Steel’s €26.9bn ($35.5bn) takeover of Arcelor in June, easily Mr Mittal’s biggest and hardest deal to date. The initial bid was followed by a five-month war of words that pitted Mr Mittal against Arcelor’s Luxembourg-based management, who fiercely opposed the transaction, and an array of continental European politicians, who resisted the venture on the grounds that it would lead to job cuts and destroy a “European industrial champion”. Mittal prevailed.

His victory led to the creation of Arcelor Mittal, of which he is chief executive and also the biggest shareholder, with a stake of 45 per cent. The company has annual sales of more than $80bn and 330,000 employees in 60 countries, with plants scattered across five continents. It is a colossus in an industry that, as recently as the 1990s, was considered a 150-year-old “sunset” sector. Steelmaking had fallen on hard times that were regarded as next to impossible to reverse.

Mr Mittal was just about the only person in the business to realise that earnings could be boosted through a process of consolidation to produce bigger companies with a greater capability to dictate prices to customers. Much of the empire was built through the 1980s and 1990s, with Mr Mittal taking over struggling steel plants in countries such as Trinidad and Tobago, Kazakhstan and Mexico and transforming them into profitable enterprises. At the same time, he borrowed techniques from more successful industries such as chemicals and carmaking, to increase quality and cut costs.

The nature of his business has put Mr Mittal in touch with governments across the globe and his interactions with them have been the source of some controversy. In 2001, for example, he made a £125,000 donation to Tony Blair’s Labour Party, at about the time the UK prime minister wrote to the Romanian government supporting his bid to take over Sidex, a big Romanian state-run plant. Mr Mittal donated a further £2m ($3.9m) to Labour last year, but he has not been involved in any of the recent cash-for-honours scandals in UK politics. The Indian magnate has always maintained his 2001 gift to Mr Blair was unrelated to the Sidex deal.

Mr Mittal is also close to Nursultan Nazarbayev, the long-serving president of Kazakhstan, who has been accused of human rights abuses and involvement in a bribery case in the US.

His fondness for throwing lavish parties raised eyebrows too. For one night of the six-day celebration marking his daughter’s wedding, Mr Mittal invited 1,500 guests to the palace of Versailles, near Paris. That went down badly with one prominent Indian industrialist, who told friends the event was “beyond decency”.

Such views, however, are not widely shared in Mr Mittal’s home country, where in recent years he has become a media celebrity. “His achievements are a sign of India emerging from the economic shadows,” says Venu Srinivasan, chairman of TVS, a big Indian maker of motorcycles. “He has inspired a whole generation of Indian entrepreneurs.” As for Mr Mittal’s zest for the high-life, Adi Godrej, chairman of Mumbai-based Godrej group, an industrial conglomerate, says: “When you have worked to make as much money as Mr Mittal has, you have the right to spend it.”

Mr Mittal’s progress in the past seven years – during which he has closed several sizeable deals prior to Arcelor, mainly buying state-owned plants in the former communist nations of eastern Europe – has pushed his company’s share of world steel production from 2 per cent to 10 per cent. The moves triggered a spate of other takeovers in the steel industry as rivals have sought to emulate his approach. These, together with a massive rise in steel consumption and production in China, have been a key factor behind a startling turnround in investor sentiment towards the steel business.

But his business dealings are part of a phenomenon whose impact goes well beyond the steel industry. Until 2004, when Mr Mittal bought the US-based International Steel Group, nearly all his most important steelmaking assets were in low-cost countries, away from the world’s main industrialised centres. The addition of advanced-technology steelmaking in high-cost countries to Mr Mittal’s low-cost base is an example of “reverse globalisation”. This term describes how, against the prevailing currents of the past century, businesses in western Europe and North America are increasingly being acquired by rivals in Asia and other emerging regions.

Yet while Mr Mittal is no doubt a part of this broader trend, categorising him as simply the product of “low-cost” economies is too simplistic. “When you talk to Mr Mittal, you get an impression of a truly global person. His background is Indian but he appears to transcend any particular environment,” says Ferdinando “Nani” Beccalli-Falco, president of the non-US operations of General Electric, the world‘s biggest industrial group.

While Mittal Steel, Mr Mittal’s main

company prior to the Arcelor deal, has often been

described as Indian, Mr Mittal’s operational base

since 1995 has been in London, with the company’s

formal headquarters in Rotterdam. London is also where Mr

Mittal has his main residence: a £53m neo-Palladian

mansion bought from the motor racing magnate Bernie

Ecclestone. It stands in stark contrast to the humble

dwelling with no electricity in Rajasthan, a

poverty-stricken part of northern India, where Mr Mittal

spent his early years, before going to Kolkata to work at

a steel plant run by his father, Mohan Mittal.

While Mittal Steel, Mr Mittal’s main

company prior to the Arcelor deal, has often been

described as Indian, Mr Mittal’s operational base

since 1995 has been in London, with the company’s

formal headquarters in Rotterdam. London is also where Mr

Mittal has his main residence: a £53m neo-Palladian

mansion bought from the motor racing magnate Bernie

Ecclestone. It stands in stark contrast to the humble

dwelling with no electricity in Rajasthan, a

poverty-stricken part of northern India, where Mr Mittal

spent his early years, before going to Kolkata to work at

a steel plant run by his father, Mohan Mittal.

Mr Mittal thinks of himself as a “global citizen”. But he is “proud” to have retained his Indian passport and speaks glowingly of economic prospects in India, which he frequently visits, especially since his decision last year to build a $9bn steel plant in India – his first big investment in the country.

Invariably calm and understated and with a meticulous approach to planning, Mr Mittal has a reputation as a great dealmaker who can win over adversaries by low-key but forceful reasoning. He is also said by people who know him to inspire tremendous loyalty among his key staff, several of whom have worked for him for two decades. “He’s got the ability to convey a vision and to convince people he can implement it,” says Georges Ugeux, chairman of Galileo Global Advisors, a New York investment group. “If people voice objections, he doesn’t take these as offence to him. He says, ‘You’re right on this, but wrong on that’ and then advances a series of options that can normally win the discussion. He has a combination of charm and seductiveness which can be quite powerful.”

As might be expected of someone who has had the resourcefulness to push through so many unexpected deals, there is another, more complex side to his character. One banker who knows him says there is “a slight element of subversiveness” in his style. Another says there is something “a little bit devilish” about him. “He seems to enjoy the fact that a lot of the time people don’t really know what his game plan is and are scratching around for the answers.”

A former colleague who “greatly respects” the steel tycoon says Mr Mittal sometimes practises “deliberate misdirection” to win arguments. Pressed into discussing his operating style, Mr Mittal says: “You can say I think ‘outside the box’. If I go into a meeting and there’s an agenda I disagree with, then I’d change it or at least put it in a different order.”

The approach was evident from the very beginning. In 1975, Mohan Mittal sent his eldest son to Indonesia to sell a piece of land. It was Lakshmi’s first foreign trip, squeezed in before a holiday to Japan. But the young Mr Mittal decided, soon after arriving, that the country’s economic prospects were so strong that it would be better to ignore his father’s instructions and build a steel plant on the land instead. Cancelling his vacation plans, he stayed in Indonesia for several weeks, arranging loans from local businessmen. Wasn’t his father annoyed that his son took such a contrarian approach? “I saw an opportunity, and explained it to my father,” Mr Mittal says. “I asked for his support and he gave it.”

The plant was a success; the younger Mr Mittal expanded it tenfold by the late 1980s to produce 400,000 tonnes of steel a year. Mohan – still chairman of Mumbai-based Ispat Industries, the largely Indian steel group from which Lakshmi separated his interests in 1994 – is said by people who know the family to have fallen out periodically with his son about some of his more risky ventures. These included a 1995 plan to buy a rusting steel plant in Kazakhstan – at that time a country emerging from Soviet rule that few people could even locate on a map – that later turned out to be wildly profitable. But the two men still get on well enough for Lakshmi to have hosted his father’s 80th birthday party at a lavish event in London in October.

At about the same time, Mr Mittal threw another party that was as unconventional as its host. To celebrate the Arcelor victory a few months earlier, the billionaire hired Brocket Hall, a stately home just north of London, and invited 100 or so bankers and other advisers who had worked on the transaction. The party was themed “Mittal’s 111” – a reference to the 1960 Hollywood film Ocean’s Eleven, starring Frank Sinatra as former soldier Danny Ocean, who decides to rob Las Vegas’s richest casinos in a series of daring and improbable raids with 10 of his friends. In posters for the party, Mr Mittal cast himself in Frank Sinatra’s role while Sam Harmon – Ocean’s key confederate, played in the film by Dean Martin – was filled by Aditya Mittal, Mr Mittal’s son, with whom he has a very close relationship and who is Arcelor Mittal’s chief financial officer.

While most company chiefs may blanch at being compared to a man planning a casino heist, Mr Mittal is sufficiently confident to think that no one will take the link too literally. Almost certainly, the connection between his own exploits in doing the impossible in the steel industry and that gang of Las Vegas robbers caused Mr Mittal some quiet amusement.

With Mr Mittal giving every indication that he intends to spend the next few years planning further “raids” on outposts of the steel sector, it may be appropriate to think that the comparison between himself and Sinatra can be taken further. After all Sinatra – whom Humphrey Bogart called “chairman of the board” – used in his own industry a mixture of panache and perseverance to pull off unexpected achievements. As he skis up hills this Christmas holiday, Mr Mittal may even be humming to himself one of Sinatra’s signature lines: “I did it my way.”

Copyright The Financial Times Limited 2006