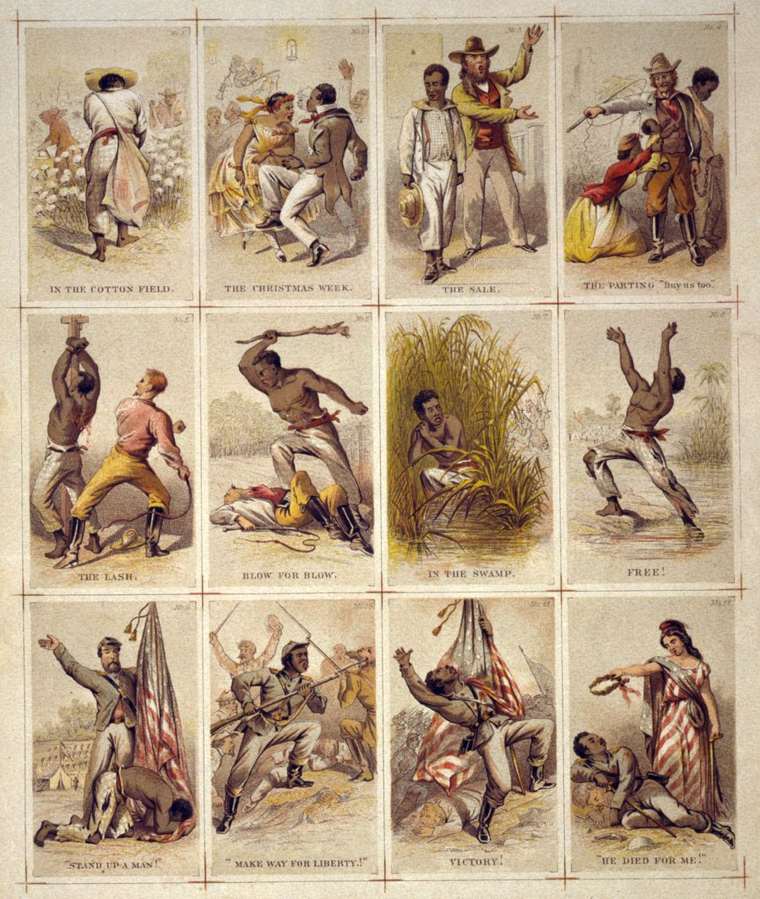

| THE HANDSTAND | MARCH2009 |

after all

we play the american game....

the

shocking truth of the Geitner "Put"

Does Geithner

really think he can sneak this by the American people?

by Mike Whitney

February 25, 2009

http://www.globalresearch.ca/index.php?context=va&aid=12462

Timothy Geithner is putting the finishing touches on a plan that will dump $1 trillion of toxic assets onto the US taxpayer. The plan, which goes by the opaque moniker the "Public-Private Investment Fund" (PPIF), is designed to provide lavish incentives to hedge funds and private equity firms to purchase bad assets from failing banks. It is a sweetheart deal that provides government financing and guarantees for illiquid mortgage-backed junk for which there is no active market. As one might expect, the charismatic President Obama has been called in to generate public support for this latest addition to the TARP bailout. In this week's address to Congress he said:

"This administration is moving swiftly and aggressively to restore confidence, and re-start lending.We will do so in several ways. First, we are creating a new lending fund that represents the largest effort ever to help provide auto loans, college loans, and small business loans to the consumers and entrepreneurs who keep this economy running."

The Obama administration is clearly afraid to use the unpopular Geithner to sell this boondoggle to the American people. Geithner's last performance set off a political firestorm and put the equities markets into a swan-dive. No one wants to see that again.Details of the plan remain sketchy, but the PPIF will work in concert with the Fed's new lending facility, the Term Asset-Backed Securities Loan Facility, or TALF, which will start operating in March and will provide up to $1 trillion of financing for buyers of new securities backed by credit card, auto and small-business loans. Geithner's financial rescue "partnership" will also focus on cleaning up banks balance sheets by purging mortgage-backed securities. (MBS)

In Monday's New York Times, Paul Krugman summed up the Geithner plan like this:

"Now the administration is talking about a “public-private partnership” to buy troubled assets from the banks, with the government lending money to private investors for that purpose. This would offer investors a one-way bet: if the assets rise in price, investors win; if they fall substantially, investors walk away and leave the government holding the bag. Again, heads they win, tails we lose.Why not just go ahead and nationalize?"Why not, indeed, except for the fact that Geithner's main objective is to "keep the banks in private hands" regardless of the cost to the taxpayer. The Treasury Secretary believes that if he presents his plan a "lending program" rather than another trillion dollar freebie from Uncle Sam, he'll have a better chance slipping it by Congress and thereby preserving the present management structure at the banks. Keeping the banking giants intact is "Job 1" at the Treasury.

The PPIF is a way of showering speculators with subsidies to purchase non-performing loans at bargain-basement prices. The Fed is using a similar strategy with the TALF which, according to the New York Times, could easily generate "annual returns of 20 percent or more" for those who borrow from the facility.

From the New York Times:

"Under the program, the Fed will lend to investors who acquire new securities backed by auto loans, credit card balances, student loans and small-business loans at rates ranging from roughly 1.5 percent to 3 percent.Depending on the type of security they are borrowing against, investors will be able to borrow 84 percent to 95 percent of the face value of the bonds. Investors would not be liable for any losses beyond the 5 percent to 16 percent equity that they retain in the investment.In the initial phase, the Treasury will provide $20 billion and the Fed will provide $180 billion. Treasury Secretary Timothy Geithner said last week that the Treasury could increase its commitment to $100 billion to allow the Fed to lend up to $1 trillion."

This is a blatant ripoff, which is why the plan is being concealed behind abstruse acronyms and complex explanations of how the transactions actually work. The only way investors can lose money is if they hold on to the securities after they fall below 16 percent of their original value which, of course, is unlikely, since the buyers can bail out at any time leaving the taxpayer holding the bag. Call it the "Geithner Put", another gift from Uncle Sugar to Wall Street land-sharks.Geithner thinks that by obfuscating the details of his plan, he'll be able to carry it off with no one the wiser. But he's mistaken. His credibility has already been badly battered by his chronic evasiveness. Now the pundits are blaming him for falling consumer confidence and the plummeting stock market. Whatever plan Geithner proposes, will be put under a microscope and dissected word by word. He won't get a second chance to pull the wool over the public's eyes. If he botches the rescue operation, Obama will be forced to give him the sack. The political furor would be too much to bear.

It is no surprize that the Fed announced its expansion of the TALF on the same day that Geithner presented his outline for a "public-private partnership". The two plans represent the Obama Team's strategy for "squaring the circle", that is, for keeping the big banks in private hands while purging their balance sheets of worthless assets at the public's expense. Here's how it's presented on the Fed's website:

"Under the TALF, the Federal Reserve Bank of New York will provide non-recourse funding to any eligible borrower owning eligible collateral... As the loan is non-recourse, if the borrower does not repay the loan, the New York Fed will enforce its rights in the collateral and sell the collateral to a special purpose vehicle (SPV) established specifically for the purpose of managing such assets... The TALF loan is non-recourse except for breaches of representations, warranties and covenants, as further specified in the MLSA"

Non-recourse funding? In other words, the loans will be like mortgages, where if the homeowner finds that he is underwater, he can just walk away and leave the bank to cover the losses? In this case, it is the taxpayer who will be left taking the loss.The PPIF is basically the same deal, 90 percent government-funded "no risk" financing offered to the same speculators who just blew up the financial system. It's a complete scam. The process allows Geithner to avoid assigning a market value to these garbage assets that no one wants. That means that he's planning to pay inflated prices--up to $1 trillion-- to keep the banks happy. Once their balance sheets are scrubbed clean, the banks can begin engineering their next swindle. Meanwhile, the hedge funds and private equity firms will demand refunds for the toxic waste they bought but cannot offload on skeptical investors. Once again, the government will pick up the tab. No problem.

The markets aren't going to like the idea of recapitalizing the banks through the backdoor. Wall Street will see right through the smoke n' mirrors and hit the "sell" button. If the banks need recapitalizing, they will have to do it the old fashion way. They'll have to restructure their capital, which means that shareholders get the ax, bond holders get a haircut, management gets the door, and the American people become majority shareholders. That's how it works in a free market. When businesses are insolvent; they file for bankruptcy and the debts are written down. Period. No exceptions. Geithner thinks he can just make up the rules as he goes along, but he's in for a big surprise. This plan is not going to fly. The banks are going to have to take their lumps and start over. Geithner could save us all a lot of trouble by just doing his job and nationalizing them now.

The Baseline Scenario's Simon Johnson put it perfectly when he said:

"Above all, we need to encourage or, most likely, force the large insolvent banks to break up. Their political power needs to be broken, and the only way to do that is to pull apart their economic empires. It doesn’t have to be done immediately, but it needs to be a clearly stated goal and metric for the entire reprivatization process."

The Hellish Structure of The Government Plan for Irish

working People to finance the Country and the Banks and

the Villains Who originally ran off with both Loans of

500 million each and their Own savings, and every pension

fund they could find bundled up in their pockets or the

wife's skirts....

Insurance levy could lead to age

discrimination

Sunday Business Post, February 15, 2009

By Emma Kennedy

They said that the terms of the

legislation behind the levy could make older employees

less attractive to employers which operate group health

insurance schemes. That is because the cost to employers

of providing health insurance for people over 50 looks

set to rise.

A spokesman for the Department of Health and Children

confirmed that concerns had been raised about the issue.

‘‘Representations have been received concerning

the issue, and these will be considered in the normal

course as the bill is progressed,” he said.The

government announced the introduction of a new health

insurance levy last November and issued draft legislation

in December. The scheme provides increased tax relief for

private health insurance premiums for people aged 50 and

older. Since January 1, health insurance companies have

faced a levy of €160 a year for each adult they have

on their books and €53 for each child. A system of

tiered tax relief has also been introduced, ranging from

€200 a year for those aged between 50 and 59 to

€1,175 for people aged 80 or more.

At present, employers which operate group health

insurance schemes pay the net premium to the insurer and

the tax relief to the Revenue Commissioners, meaning they

pay the gross premium overall for each employee. A

subsection of the new Health Insurance (Miscellaneous

Provisions) Bill states that employers will continue to

pay the gross premium overall for employees, including

the payment of the age-related tax credit to the Revenue

Commissioners.

This means that employers will face higher charges for

employees aged 50 or over. Experts in the health

insurance industry have said that this could factor into

the recruitment process, making it harder for older

people to get hired.

www.friedmanArchives.com

Legal aid critical of mortgage code

Irish Times,Wednesday, February 18, 2009

PAMELA NEWENHAM

THE NEW mortgage arrears code issued by the Financial Regulator has been criticised by the Free Legal Advice Centres (Flac), which says it does not sufficiently protect borrowers.

Flac described the code of conduct on mortgage arrears, which will come into effect on February 27th, as “deeply disappointing”.

It said the code failed to deal with a number of important aspects of mortgage arrears, including the sanctions that may be imposed for breaches of the code, or the legal costs that a lender may recover.

As originally drafted, the code provided for an accumulation of six months’ arrears before court proceedings could be issued, said Flac director general Noeline Blackwell.

“The new and final version reduces that protection, such that a lender may start proceedings six months after any arrears at all, without requiring that the full six months must be owing,” she said.

Ms Blackwell also criticised the language in the code as vague and ambiguous, making it difficult to enforce: “The code gives guidance to lenders, urging them to deal sympathetically with borrowers in difficulty, but allows a number of escape routes for lenders who wish to short-circuit the code.”

In December, the group, which provides free legal advice centres around the country, criticised the Government and the regulator for underestimating the extent of the mortgage arrears problem.

“The Government states that it is fully committed to protecting those at risk but will rely upon the industry to police itself through its voluntary code on mortgage arrears.”

On the figures produced by both the Government and the Financial Regulator, the legal rights body noted that only the number of repossessions by court order is quoted, not the number of applications for repossession.

“It is no secret that subprime lenders in particular have flooded the High Court with applications for repossession over the past 12 months . . . How many of these applications have resulted in the sale or loss of the family home prior to any order being granted?” Ms Blackwell asked.

The Money Advice and Budgeting Service (Mabs) welcomed the new code, saying it strengthens the need for stronger communication between the lender and debtor.

A spokesman for the service said: “We feel people in difficulty with their mortgage can use the new code to their advantage if they contact the lender early.”

This article appeared in the print edition of the Irish Times

ahern to bolster rights of mortgage holders

Irish Times,Sunday,

February 08, 2009

By Emma Kennedy

Minister for Justice Dermot Ahern plans to close a legal

loophole that allows lenders to sell the properties of

borrowers who are in arrears.

Ahern is understood to be considering revising existing

legislation in order to protect homeowners. The move is

being taken in light of the collapse of the property

market, and the increase in the number of home

repossessions by lenders.

Under the Conveyancing Acts 1881-1911, financial

institutions can sell the properties of borrowers who are

in arrears without having to seek a court order.

While this has rarely happened in Ireland, it was decided

that amendments to the legislation were required in order

to safeguard homeowners.

It is understood that Ahern intends to introduce further

amendments to the Land and Conveyancing Law Reform Bill

2006,which is currently at committee stage. The reform

bill provides for a comprehensive overhaul of land law

and conveyancing law.

It follows the publication in October 2004 of a

consultation paper and the subsequent publication of a

Law Reform Commission Report in July 2005. The bill,

which is based on a draft contained in that report, was

presented in the Seanad in June 2006.

A further amendment to this bill is expected to be

introduced in the coming weeks.

The amendment would make it necessary for a lender to

possess a court order, in order to exercise its power of

sale in relation to a mortgage in arrears.

Concern over Nenagh

bypass

The National Road Authority (NRA) and officials from

Limerick County Council met Bothar Hibernian, the

consortium selected to build the road, seeking

reassurances that the consortium was paying

subcontractors for all works carried out on the project.

The NRA and the council have received a number of

complaints from sub-contractors who have worked on the

project.One contractor, Lowry Piling, has issued High

Court proceedings against the consortium in an effort to

secure money it claims it is owed. The matter was

mentioned in court last week.

Bothar Hibernian is a joint venture between developer and

builder Bernard McNamara, Irish firm Coffey Construction

and Mota-Engil Engenharia, a €1.3 billion Portuguese

construction group.

During the meeting, representatives from Bothar Hibernian

gave assurances that all contractors would be paid for

work carried out, and also provided details of a number

of payments in the run-up to the Christmas break last

year.But remember that Macnamara, having lost a riding

whip and a wallet at that time (Not to a pickpocket but

by falling off his horse...). refused to build Counil

Houses for 3 Contracts in Dublin

Doctors in Jeopardy

More than 1,000 doctors attended meetings held by the IMO

in Cork and Dublin last week to discuss the Health

Service Executive (HSE) measures. Finbarr Murphy,

director of industrial relations at the IMO, said doctors

were angry about the proposed cuts, which the IMO said

would result in a 40 per cent loss of earnings.

The US State Department

has warned American tourists coming to Ireland that the

country is experiencing a rapid increase in drug crime,

that Irish people drive too aggressively, and that there

are not enough police adequately to cover the entire

country.

Anglo Irish Bank moved to protect

its lendings.

Bono stung by the international hypocrisy "of people

who run with the stereotype and caricature of U2"

"I can't speak up without betraying my relationship

with the Band"

"THEY" WOULD SAY THIS WOULDN'T THEY?

"They" estimate that total

banking losses in Ireland could reach €30 billion,

which is significantly higher than existing estimates by

the government or banks.In the next three years, more

than 100 per cent of Irish GDP will need to be refinanced,

split evenly between non-financial corporate debt,

financial corporates and the public sector. This debt

will be much more expensive to refinance than was

previously the case.

billion,

which is significantly higher than existing estimates by

the government or banks.In the next three years, more

than 100 per cent of Irish GDP will need to be refinanced,

split evenly between non-financial corporate debt,

financial corporates and the public sector. This debt

will be much more expensive to refinance than was

previously the case.

Ireland comes last in five of the nine sub-indices.

According to the report, Ireland faces huge pressure in

funding its short-term financing needs, which are the

highest in the euro area.

aFTER ALL WE PLAY THE aMERICAN gAME